Press release

Top 30 Indonesian Health Public Companies Q3 2025 Revenue & Performance

1) Overall health companies performance (Q3 2025 snapshot)Indonesias listed healthcare universe (pharmaceuticals, consumer health, hospitals, distribution, medical devices and labs) showed a mixed but broadly resilient Q3-2025: pharmaceuticals and consumer health firms (branded OTC, jamu, nutraceuticals) generally reported margin stability, while hospitals saw recovery in volumes and revenue vs. H1 as private patients and corporate MCU seasons improved; distributors reported steady top-line growth amid higher volumes. The IDX Healthcare sector index and recent analyst notes confirm the sectors positive momentum but with margin pressures in some hospital chains due to higher operating costs.

Representative list of major public companies active in Indonesias healthcare sector: Kalbe Farma (KLBF), Kimia Farma (KAEF), Siloam International Hospitals (SILO), Mitra Keluarga Karyasehat (MIKA), Tempo Scan Pacific (TSPC), Enseval Putera Megatrading (EPMT / ENVA), Industri Jamu & Farmasi Sido Muncul (SIDO), Indofarma (INAF), Medikaloka Hermina (HEAL), Darya-Varia Laboratoria (DVLA), Soho Global Health (SOHO), Pyridam Farma (PYFA), Sarana Meditama Metropolitan (SAME), Metro Healthcare (CARE), Awal Bros / FAM/Famon/Awal Bros group (PRAY/others listed), Organon Pharma Indonesia / SCPI, UBC Medical (LABS), Hetzer Medical (MEDS), Millennium Pharmacon (SDPC), Ikapharmindo Putramas (IKPM), Brigit Biofarmaka / other smallcaps, etc.

2) Q3-2025 earnings call summary - Top 10 public health companies

1. PT Kalbe Farma Tbk (KLBF) - Q3 2025

Headline: Q3 2025 net profit (reported figure used by analysts) ≈ IDR 2.63 trillion (Q3 / 9M line referenced in analyst note).

USD equivalent: ≈ $157.6 million.

Takeaway: Kalbe reported continued year-on-year net profit growth driven by consumer health and nutrition products and distribution scale; management signaled steady domestic demand and product mix benefits. Source: KLBF filings/analyst Q3 note.

2. PT Kimia Farma Tbk (KAEF) Q3 2025

Headline: Q3 / 9M25 reported net loss for the period of IDR 179.7 billion (improvement vs prior years larger loss).

USD equivalent: ≈ -$10.8 million.

Takeaway: Kimia Farma showed margin improvement and lower operating expenses vs. prior year but remained in a small loss position in the period; management emphasized ongoing efficiency and business transformation.

3. PT Siloam International Hospitals Tbk (SILO) - Q3 2025

Headline: Reported Q3 / 9M strong performance; one widely-reported figure for Q3 net profit noted IDR 761.3 billion (per local research/news summary).

USD equivalent: ≈ $45.6 million.

Takeaway: Siloam's Q3 bounce reflected improving patient volumes (private + elective), better occupancy trends and a sequential recovery across its hospital network; analysts noted QoQ momentum. (See Siloam filings / analyst research).

4. PT Mitra Keluarga Karyasehat Tbk (MIKA) Q3 / 9M 2025

Headline: 9M25 PATMI ~ IDR 1.0 trillion (reported by research coverage citing company 9M results).

USD equivalent: ≈ $59.9 million.

Takeaway: Mitra Keluarga reported stable margin trends and an accelerating private patient mix in Q3 (corporate MCUs and seasonal volumes supportive). Analysts highlighted durable margin expansions due to cost control.

5. PT Tempo Scan Pacific Tbk (TSPC) - Q3 2025

Headline: Q3/9M25 net profit reported IDR 1.14 trillion (quarterly/9M disclosures aggregated in research note).

USD equivalent: ≈ $68.3 million.

Takeaway: Tempo Scan's diversified pharma and consumer health portfolio delivered resilient top-line and stable net profit; company noted steady OTC and prescription sales.

6. PT Enseval Putera Megatrading Tbk (ENVA / EPMT) - Q3 2025

Headline: 9M25 net profit ≈ IDR 603.4 billion; net sales ~ IDR 24.4 trillion (analyst/company release).

USD equivalent (profit): ≈ $36.2 million.

Takeaway: Distributor Enseval reported steady revenue growth (~+5% YoY) and modest operating profit expansion; higher distribution volumes partly offset cost pressures.

7. PT Industri Jamu & Farmasi Sido Muncul Tbk (SIDO) - Q3 2025

Headline: 9M25 net profit IDR 818.5 billion (company/analyst notes).

USD equivalent: ≈ $49.0 million.

Takeaway: SIDO's margin gains (better gross margin mix) were somewhat offset by higher opex (marketing); 3Q saw sequential revenue growth but some QoQ pressure due to seasonality of advertising spend.

8. PT Indofarma Tbk (INAF) - Q3 2025

Headline: Q3/9M25 - reported net loss ~ IDR 127.1 billion for the period covered (company filing / press coverage).

USD equivalent: ≈ -$7.6 million.

Takeaway: Indofarma reduced losses vs. prior periods via cost controls but still recorded a small operating/net loss; company strategy centers on operational turnaround and product rationalization.

9. PT Medikaloka Hermina Tbk (HEAL) Q3 2025

Headline: 9M25 net profit IDR 356.0 billion; Q3 profit noted around IDR 131.0 billion in some analyst writeups.

USD equivalent (9M): ≈ $21.3 million (9M figure).

Takeaway: Hermina's revenues rose but net profit was down YoY due to GPM pressure and higher operating costs; Q3 saw sequential recovery in admissions (corporate MCU season) but margin compression remained a headwind.

10. PT Darya-Varia Laboratoria Tbk (DVLA) - Q3 2025

Headline: Q3 2025 net profit IDR 164.3 billion (company/analyst report).

USD equivalent: ≈ $9.8 million.

Takeaway: Darya-Varia posted modest profit growth vs. prior year, driven by core pharmaceutical sales; company reported steady working capital metrics.

3) Key trends & insights from Q3 2025

Hospital recovery but margin pressure: Hospital chains (Siloam, Mitra Keluarga, Hermina) reported rising admission volumes and improved private patient mix in Q3, driven by resumed elective procedures and corporate MCUs but many hospitals flagged wage inflation, higher utility costs, and supply costs that compressed GPM/EBIT margins. Analysts noted sequential QoQ improvements in volumes but mixed margin signals.

Pharma & consumer health resilience: Large pharma/consumer health names such as Kalbe, Tempo Scan and Sido Muncul continued to show resilient top lines and relatively stable gross margins, helped by diversified portfolios (OTC, nutrition, prescription). Kalbes scale continues to be a competitive advantage.

Distributor strength and working capital normalization: Distributors (Enseval) reported steady sales growth and improved operating profit, benefiting from broad product distribution and higher pharma volumes. Working capital cycles remain a monitoring point.

Turnaround stories remain mixed: State-linked players and some midcaps (Indofarma, Kimia Farma) showed improvement in cost structures but remained challenged by legacy issues and inventory / pricing dynamics some still posted small losses in 9M25.

FX & macro sensitivity: Although most revenues are domestic (IDR), currency movements affect imported ingredients, capex and medical equipment costs companies flagged FX volatility as a risk to margins. Bank/market FX at end-Q3 2025 averaged ~IDR 16.6k16.9k per USD.

4) Outlook Q4 2025 and beyond

Q4 seasonality + year-end corporate health checks should provide a typical boost to hospital outpatients (MCU) and some elective procedures hospitals with strong cost control and diversified payor mix will likely continue to outperform. Analysts appear relatively constructive on hospital revenue recovery but cautious about margin sustainability.

Pharma/consumer health: expect steady demand for OTC and nutritional products (Kalbe/Tempo/Sido), with pricing discipline and product mix continuation supporting margins. M&A or portfolio optimization may pick up if valuations remain attractive.

Distribution & logistics players (Enseval) should benefit from continued pharma volume growth; watch working-capital and trade receivables trends.

Risks: Cost inflation (wages, utilities), FX spikes (imported raw materials/equipment), regulatory changes (drug pricing, BPJS policies) and slower global growth remain the primary downside risks. Monitoring Q4 guidance from management teams will be key.

5) Conclusion

Q3-2025 was a mixed but constructive quarter for Indonesias listed healthcare sector. Large, diversified names (Kalbe, Tempo Scan, Sido) delivered stable profits; hospital chains reported recovering volumes though margin headwinds remain; distributors kept steady growth. Some state-linked and turnaround names remain loss-making but show signs of improvement. For investors and industry watchers the themes to watch into Q4-2025 are patient-volume trends at hospitals, margin trajectories as companies pass through cost inflation, the FX path for imported inputs, and corporate actions (efficiency programs, M&A) by the larger groups.

Contact Information:

Tel: +1 626 2952 442 (US) ; +86-1082945717 (China)

+62 896 3769 3166 (Whatsapp)

Email: willyanto@qyresearch.com; global@qyresearch.com

Website: www.qyresearch.com

About QY Research

QY Research has established close partnerships with over 71,000 global leading players. With more than 20,000 industry experts worldwide, we maintain a strong global network to efficiently gather insights and raw data.

Our 36-step verification system ensures the reliability and quality of our data. With over 2 million reports, we have become the world's largest market report vendor. Our global database spans more than 2,000 sources and covers data from most countries, including import and export details.

We have partners in over 160 countries, providing comprehensive coverage of both sales and research networks. A 90% client return rate and long-term cooperation with key partners demonstrate the high level of service and quality QY Research delivers.

More than 30 IPOs and over 5,000 global media outlets and major corporations have used our data, solidifying QY Research as a global leader in data supply. We are committed to delivering services that exceed both client and societal expectations.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Top 30 Indonesian Health Public Companies Q3 2025 Revenue & Performance here

News-ID: 4301187 • Views: …

More Releases from QY Research

Tin Silver Solder: Strengthening Thermal Fatigue Resistance in Advanced Electron …

Tin Silver Solder is a lead-free solder alloy primarily composed of tin (Sn) and silver (Ag), engineered for high-reliability electronic and electrical interconnections. It is widely used in printed circuit board (PCB) assembly, semiconductor packaging, automotive electronics, and aerospace applications where strong mechanical bonding and superior thermal fatigue resistance are required. Compared to traditional tin-lead solders, tin-silver alloys exhibit higher melting points, improved joint strength, and excellent wetting on copper…

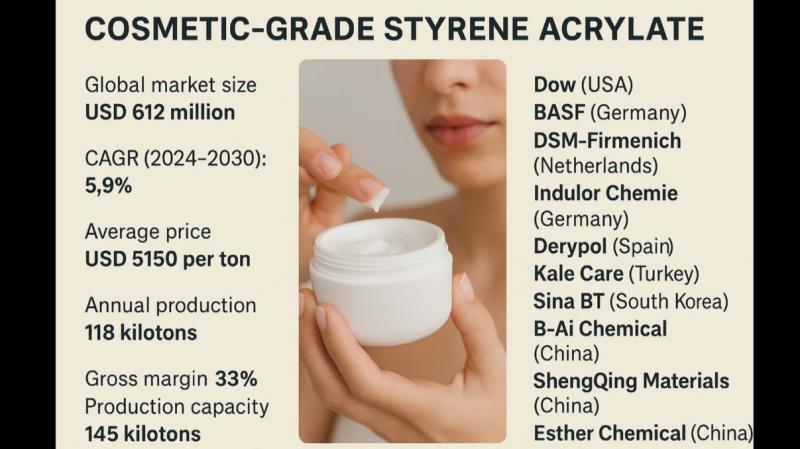

Cosmetic-Grade Styrene Acrylate: A USD 612 Million Market Powering Premium Makeu …

QY Research has released a comprehensive new market report on Cosmetic-Grade Styrene Acrylate, a specialty polymer widely used as a film former, rheology modifier, and performance enhancer in personal care and cosmetic formulations.

https://www.qyresearch.com/reports/5444850/cosmetic-grade-styrene-acrylate

Why Cosmetic-Grade Styrene Acrylate Matters

Strong adhesion with flexible film formation

Excellent resistance to water, sweat, and sebum

High transparency for natural, high-definition finishes

Improved pigment dispersion and formulation stability

Comfortable, non-occlusive wear experience

Core Market Snapshot

Global market size: USD 612 million

CAGR (2024-2030): 5.9%

Average…

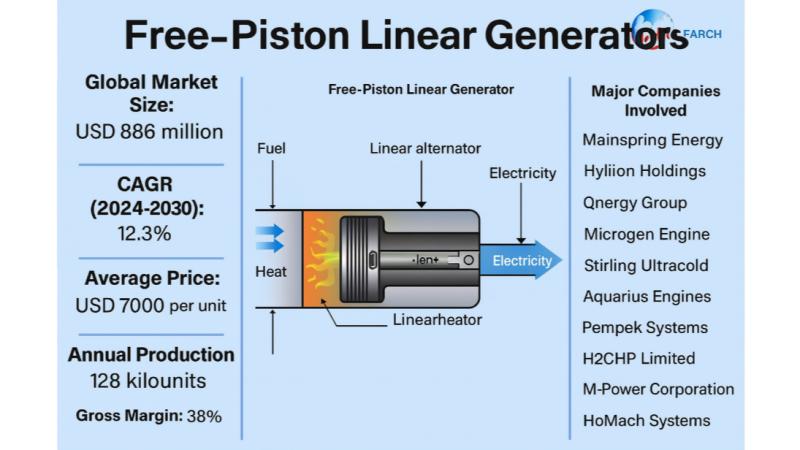

Global and U.S. Free-Piston Linear Generators Market Report, Published by QY Res …

QY Research has released a comprehensive new market report on Free-Piston Linear Generators, advanced energy-conversion systems that directly transform reciprocating piston motion into electrical power without a crankshaft mechanism. By combining free-piston engines with linear electric generators, these systems achieve high efficiency, fuel flexibility, compact architecture, and reduced mechanical complexity. As global demand grows for efficient distributed power, hybrid powertrains, range extenders, and low-emission energy solutions, the report delivers an…

Global and U.S. Electrochemical Transducers Market Report, Published by QY Resea …

QY Research has released a comprehensive new market report on Electrochemical Transducers, sensing components that convert chemical reactions-such as oxidation-reduction processes-into measurable electrical signals. These transducers are fundamental to gas sensors, biosensors, environmental analyzers, medical diagnostics, and industrial process monitoring, where high sensitivity, selectivity, and low power consumption are critical. As demand grows for real-time chemical detection, portable diagnostics, and regulatory-grade monitoring systems, this report delivers an in-depth assessment of…

More Releases for IDR

Indonesia Plastic Pipes Market Crosses IDR 26 billion Milestone- Latest Insights …

Comprehensive market analysis maps exponential growth trajectory, investment opportunities, and strategic imperatives for industry leaders in Indonesia's expanding infrastructure ecosystem

Delhi, India - September 11, 2025 - Ken Research released its strategic market analysis titled "Indonesia Plastic Pipes Market Outlook to 2029," revealing that Indonesia's plastic pipes market, currently valued at IDR 26 billion, is projected to surpass USD xx billion by 2029. The comprehensive analysis details how demand from water…

Sector Spotlight: 4 Stocks Riding the Gold Surge (SDRC, GOLD, PPTA, IDR)

Gold mining stocks are having a moment. In the early months of 2025, shares of gold miners have surged, outpacing even the price of gold itself. The VanEck Gold Miners ETF, a bellwether for the sector, is up 20% year-to-date, compared to gold's 12% rise and the S&P 500's modest 1.7% gain. This marks a significant shift from recent years, when miners often lagged behind the metal they produce.

What's driving…

Pendapatan Managed Services ATM Indonesia Diperkirakan Akan Mencapai Lebih dari …

• Diharapkan pada tahun 2023, proporsi relatif pemeliharaan situs ATM dan Perbaikan &; Pemeliharaan ATM di pasar akan membesar pada CAGR masing-masing mendekati 2% dan 4% selama periode perkiraan. Layanan manajemen kas masih akan menangkap pangsa tertinggi yang mendaftarkan CAGR mendekati 6% selama hal yang sama.

• Di pasar Pasokan ATM, proporsi pendaur ulang uang tunai diperkirakan akan meningkat pada CAGR sebesar 6%. Hal ini disebabkan oleh peningkatan mesin ATM konvensional…

Pendapatan Broker Keuangan Indonesia Diperkirakan Akan Mencapai sekitar IDR 6 Tr …

Tren Utama

• Dengan prospek ekonomi Indonesia yang stabil dan positif, fokus pemerintah pada pembangunan infrastruktur sekitar Rp 2,394 triliun pada tahun 2024, dan upaya berkelanjutan dari bursa efek dan badan-badan terkait lainnya untuk menanamkan kesadaran tentang pasar modal, nilai investasi yang diperdagangkan pasti akan membentuk pendapatan industri selama periode perkiraan.

• Ketergantungan pada pinjaman berbasis bank oleh perusahaan juga diperkirakan akan turun dan industri dapat menyaksikan peningkatan jumlah IPO, SPO dan obligasi korporasi…

Indonesia ATM Managed Services Revenue is Expected to Reach close to over IDR 9. …

• It is expected that by 2023, the relative proportion of ATM site maintenance and ATM Repair & Maintenance in the market would enlarge at a CAGR of close to 2% and 4% respectively during the forecast period. Cash management services would still capture highest share registering a CAGR of close to 6% during the same.

• In the ATM Supply market, the proportion of cash recyclers is expected to rise at…

Creosote Market 2019 | Worldwide Market Outlook 2025 | Major Manufacturers – I …

Creosote Market research report delivers a close watch on leading competitors with strategic analysis, micro and macro market trend and scenarios, pricing analysis and a holistic overview of the market situations in the forecast period.

Get Exclusive FREE Sample Copy Of this Report @ https://www.upmarketresearch.com/home/requested_sample/107001

UpMarketResearch offers a latest published report on “Global Creosote Market Analysis and Forecast 2019 - 2025” delivering key insights and providing a competitive advantage to clients through…