Press release

Consistent Growth Projected for Directors And Officers Insurance Market, Reaching $50.34 Billion by 2029

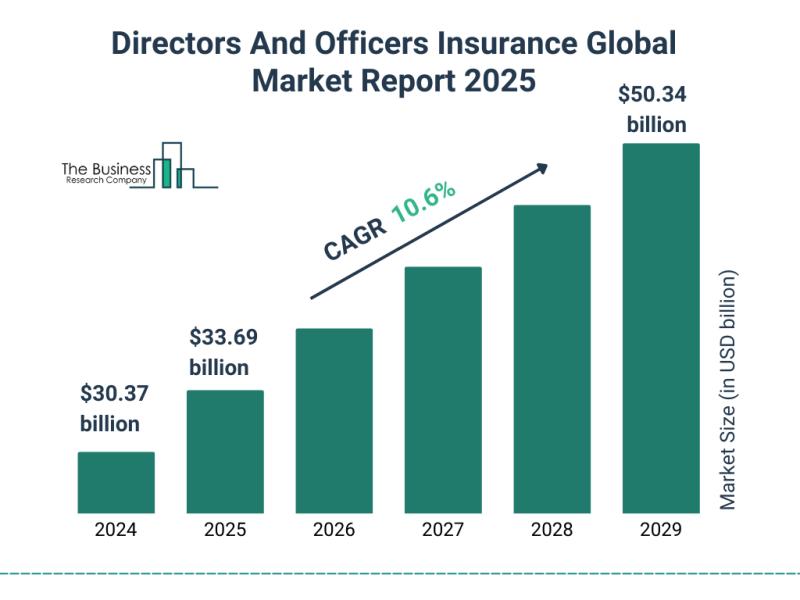

Projected Size of the Directors And Officers Insurance Market by 2025The directors and officers insurance market has expanded significantly in recent years, and its valuation is projected to climb from $30.37 billion in 2024 to $33.69 billion in 2025, reflecting a robust 10.9% CAGR. This historical growth is linked to increased corporate governance awareness, more stringent regulatory oversight, a marked rise in shareholder-driven lawsuits, elevated merger and acquisition activity, and the expanding geographic reach of multinational enterprises.

Estimated Size of the Directors And Officers Insurance Market by 2029

Looking ahead, the market is projected to reach $50.34 billion by 2029, supported by a steady 10.6% CAGR. Growth through this period is driven by mounting cyber risks and data breaches, greater incorporation of ESG standards into governance practices, increasing incidents of corporate misconduct and related legal exposure, expanding D&O offerings for small and mid-sized enterprises, and improvements in regulatory structures within emerging markets. Long-term shifts shaping the industry include the integration of AI-driven risk assessment tools, rising use of parametric D&O models, tailored policies for early-stage companies, increased appetite for ESG-linked D&O coverage, and broader adoption of digital insurance distribution channels.

Access the full Directors And Officers Insurance Market report here:

https://www.thebusinessresearchcompany.com/report/directors-and-officers-insurance-global-market-report

Growth Drivers Accelerating the Directors And Officers Insurance Market

Rising volumes of claims and legal proceedings are expected to be a key force propelling the D&O insurance market forward. These actions often stem from allegations of negligence, mismanagement, or misconduct that may impose financial or legal consequences on directors and officers. As expectations for executive accountability expand, companies and their leadership teams face heightened exposure to lawsuits tied to governance decisions.

Impact of Increasing Litigation on Market Demand

D&O insurance plays an essential role in helping organizations and their leaders navigate these mounting legal risks by covering defense costs and liabilities that arise from operational oversight and managerial responsibilities. Supporting this trend, the UK's Ministry of Justice reported in March 2025 that 1.5 million compensation-related claims were filed in 2024. Damage-related cases alone grew 2%, rising from 97,000 in 2023 to 99,000 in 2024, while money-related claims increased 8% in the final quarter year over year. As litigation volumes expand, demand for comprehensive D&O coverage continues to strengthen.

Download your free Directors And Officers Insurance Market sample now:

https://www.thebusinessresearchcompany.com/sample.aspx?id=29433&type=smp

Dominant Trends Shaping the Future of the D&O Insurance Market

Market leaders are increasingly focused on developing regionally customized underwriting practices to better align with local regulatory environments, pricing factors, and risk exposures. This approach involves tailoring policy terms, risk evaluations, and coverage structures to suit the legal and economic conditions unique to each market. Such local-market specialization enhances protection accuracy and strengthens insurer competitiveness.

Example of Innovation in Localized D&O Offerings

In August 2025, Sun Insurance Co Ltd, headquartered in Fiji, introduced a redesigned Directors and Officers (D&O) Insurance Policy specifically structured to protect company executives from personal financial liabilities arising from lawsuits, investigations, or regulatory claims related to their managerial decisions. This strategic product update reflects the growing trend of region-focused policy design across the global D&O landscape.

Key Segments Defining the Directors And Officers Insurance Market

The directors and officers insurance market covered in this report is segmented -

By Type: Employment Practice Litigations, Regulatory Investigations, Customer Suits, Accounting Irregularities

By Coverage Type: Side A, Side B, Side C

By Organization Size: Large Enterprises, Small And Medium Enterprises

By Distribution Channel: Brokers, Direct Sales, Bancassurance, Other Distribution Channels

By End-User: Public Companies, Private Companies, Non-Profit Organizations, Financial Institutions, Other End-Users

Subsegments include:

- Employment Practice Litigations: Wrongful Termination, Discrimination, Workplace Harassment, Retaliation, Contract Breach

- Regulatory Investigations: SEC inquiries, Antitrust issues, Environmental compliance probes, Financial reporting reviews, Cyber and privacy investigations

- Customer Suits: Misrepresentation, Liability claims, Breach of fiduciary duty, Inadequate disclosure, Contract disputes

- Accounting Irregularities: Misstatement of results, Earnings manipulation, Fraudulent reporting, Improper revenue recognition, Misuse of funds

Leading Companies Within the Directors And Officers Insurance Market

Major companies operating in the directors and officers insurance market include Berkshire Hathaway; Allianz; AXA XL; Zurich Insurance Group; Chubb; Liberty Mutual; Tokio Marine Holdings; Swiss Re; Munich Re; Travelers; AIG; Sompo International; The Hartford; QBE Insurance Group; Markel Corporation; Everest Re Group; Arch Insurance Group; CNA Financial; Willis Towers Watson (WTW); Beazley.

Regional Opportunities in the D&O Insurance Market

North America represented the largest market for directors and officers insurance in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. Regions examined in the report include Asia-Pacific, Western Europe, Eastern Europe, North America, South America, the Middle East, and Africa.

Purchase your detailed Directors And Officers Insurance Market report now:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=29433

This Report Supports

Business Leaders & Investors - To evaluate risks, identify new opportunities, and inform strategic planning.

Manufacturers & Suppliers - To understand changing market expectations and competitive pressures.

Policy Makers & Regulators - To track industry developments and align governance frameworks.

Consultants & Analysts - To support advisory projects, market expansion, and competitive analyses.

Reach out to us:

The Business Research Company: https://www.thebusinessresearchcompany.com/,

Americas +1 310-496-7795,

Europe +44 7882 955267,

Asia & Others +44 7882 955267 & +91 8897263534,

Email us at info@tbrc.info.

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Learn More About The Business Research Company

With over 17500+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Armed with 1,500,000 datasets, the optimistic contribution of in-depth secondary research, and unique insights from industry leaders, you can get the information you need to stay ahead.Our flagship product, the Global Market Model (GMM), is a premier market intelligence platform delivering comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Consistent Growth Projected for Directors And Officers Insurance Market, Reaching $50.34 Billion by 2029 here

News-ID: 4303121 • Views: …

More Releases from The Business Research Company

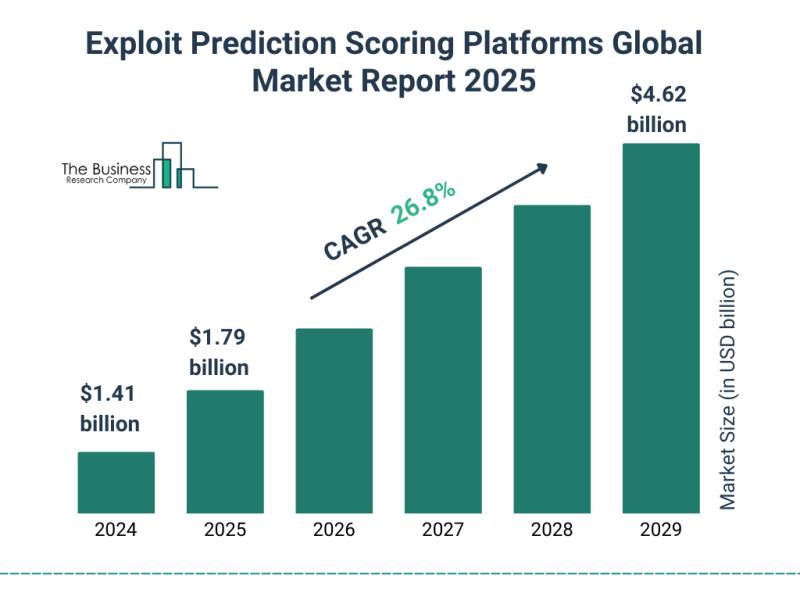

Exploit Prediction Scoring Platforms Market Poised for Robust Growth, Projected …

How Much Will the Exploit Prediction Scoring Platforms Market Size Increase by 2025?

The exploit prediction scoring platforms market continues to expand rapidly, expected to rise from $1.41 billion in 2024 to $1.79 billion in 2025, reflecting an impressive 27.1% CAGR. This growth is tied to several structural drivers: increasing adoption of automated vulnerability scanning tools, rising emphasis on proactive cybersecurity posture management, stricter compliance mandates, deepened collaboration between enterprises and…

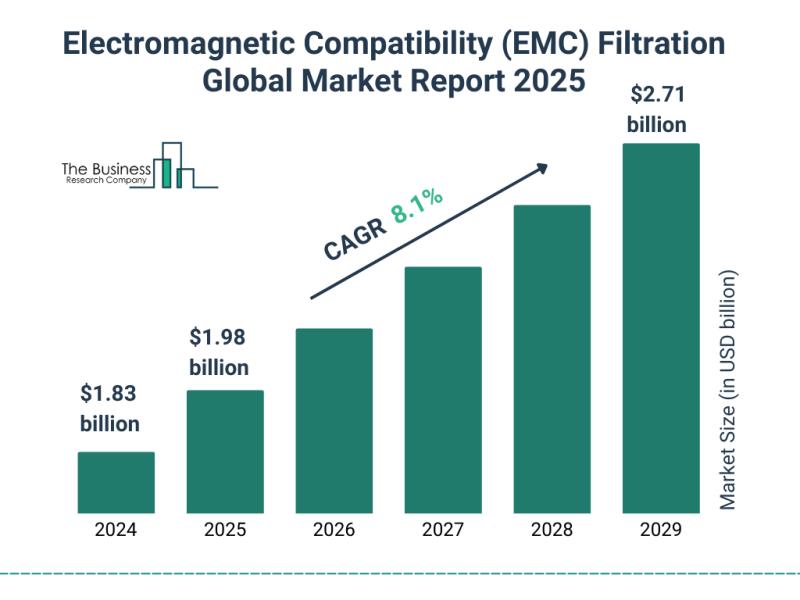

2025-2034 Electromagnetic Compatibility (EMC) Filtration Market Evolution: Emerg …

How Much Is the Electromagnetic Compatibility (EMC) Filtration Market Expected to Expand by 2025?

The global EMC filtration market has recorded steady growth in recent years and is forecast to rise from $1.83 billion in 2024 to $1.98 billion by 2025, advancing at a CAGR of 8.5%. This increase is rooted in several underlying forces: rapid proliferation of electronic devices, heightened requirements for EMC compliance in automotive subsystems, stronger adoption of…

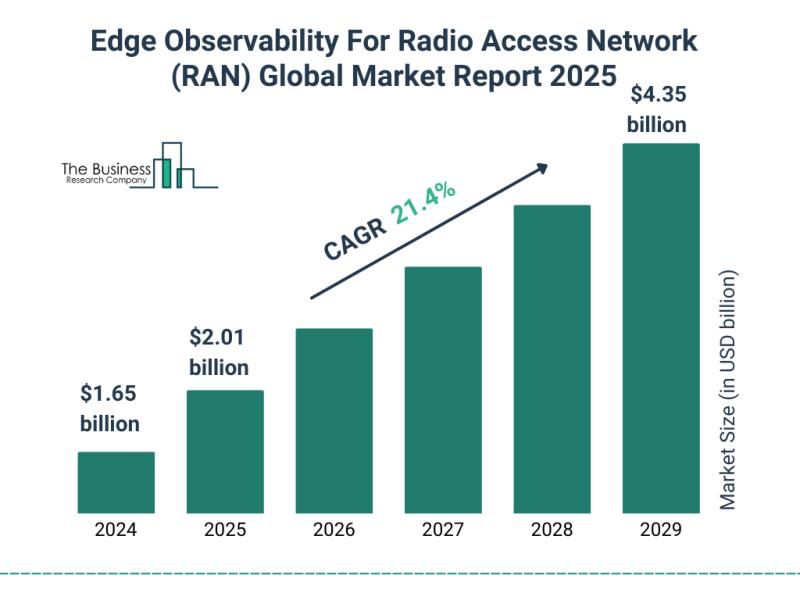

Accelerated Digital Transformation Fuels Expansion in the Edge Observability For …

How Large Is the Edge Observability For Radio Access Network (RAN) Market Expected to Be by 2025?

The edge observability for radio access network (RAN) market has expanded rapidly in recent years and is forecast to increase from $1.65 billion in 2024 to $2.01 billion in 2025, registering a strong 21.7% CAGR. Growth during the historical period is attributed to several factors, including broader deployment of virtualized RAN (vRAN) systems, heightened…

Surging Application Across End Users Powers the Expansion of the Deployment Auto …

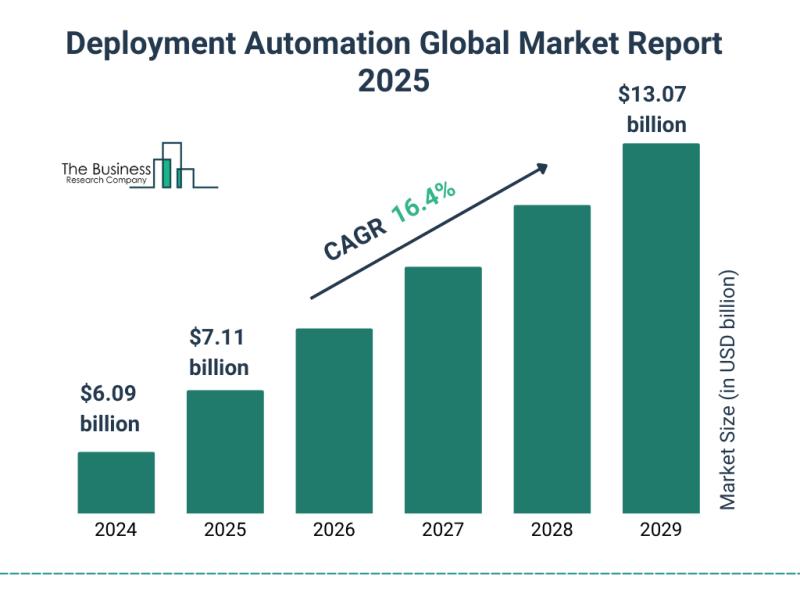

Deployment Automation Market Size Growth by 2025

The deployment automation market has expanded rapidly, with its valuation expected to rise from $6.09 billion in 2024 to $7.11 billion in 2025, reflecting a strong 16.8% CAGR. This upward momentum is rooted in several influential factors, including the growing emphasis on agility and continuous delivery, increasingly complex multi-cloud and hybrid environments, heightened demand for cost-efficient deployment processes, rising recognition of automated provisioning and…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…